The Biden administration has recently unveiled a rule aimed at capping credit card late fees, marking a substantial effort to cut down on what it terms as “junk fees.” This move is projected to save U.S. consumers approximately $10 billion annually.

New Standards for Late Fees

Under the new guidelines proposed by the Consumer Financial Protection Bureau (CFPB), late fees for credit card payments will be limited to a maximum of $8.

This is a significant reduction from the current average late fee of $32.

Taking on Junk Fees

Rohit Chopra, director of the CFPB, has been vocal about the challenges consumers face with junk fees in the financial sector.

His statement shows that the agency wants to make things easier for consumers, who currently have to navigate a market controlled by a small number of big companies.

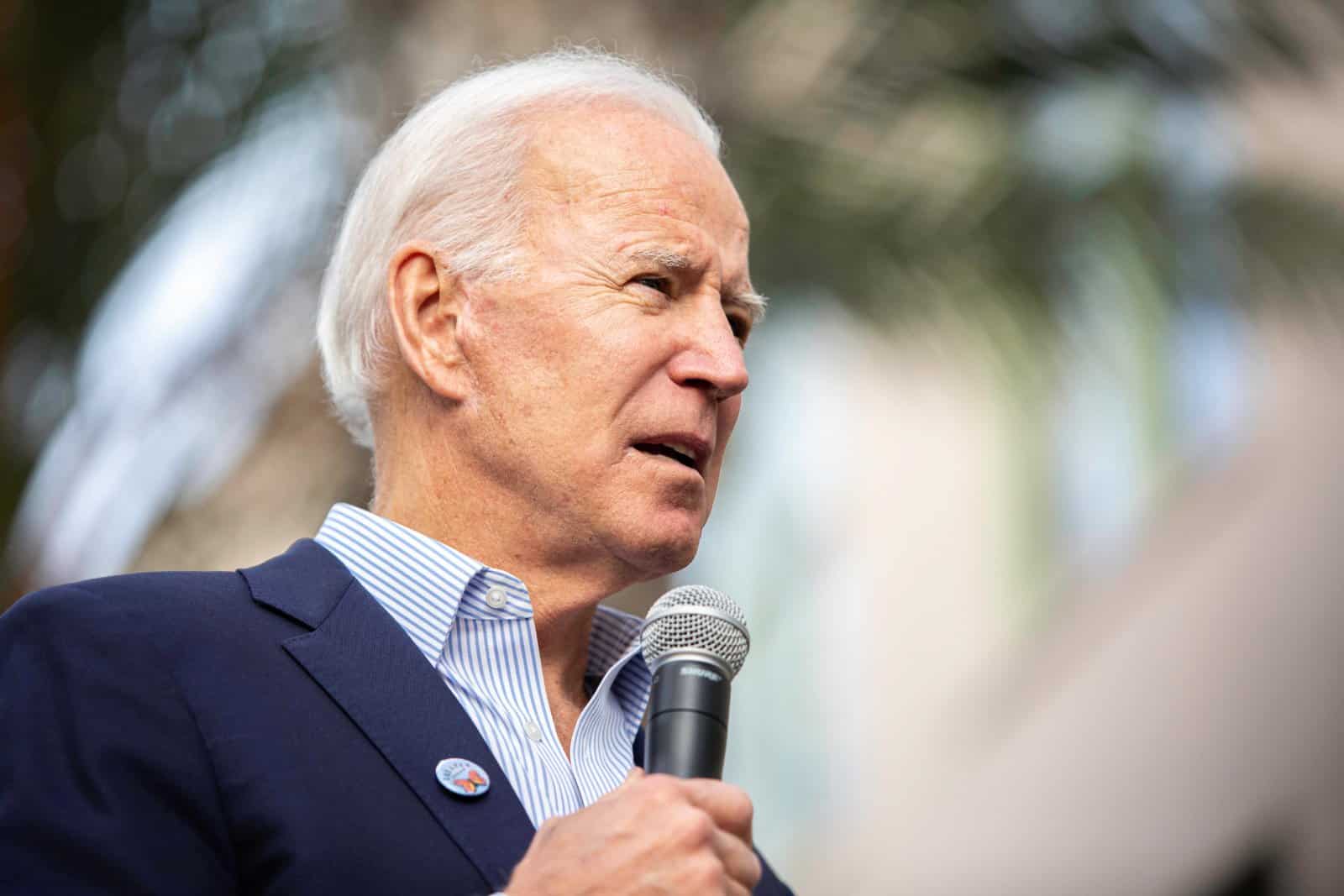

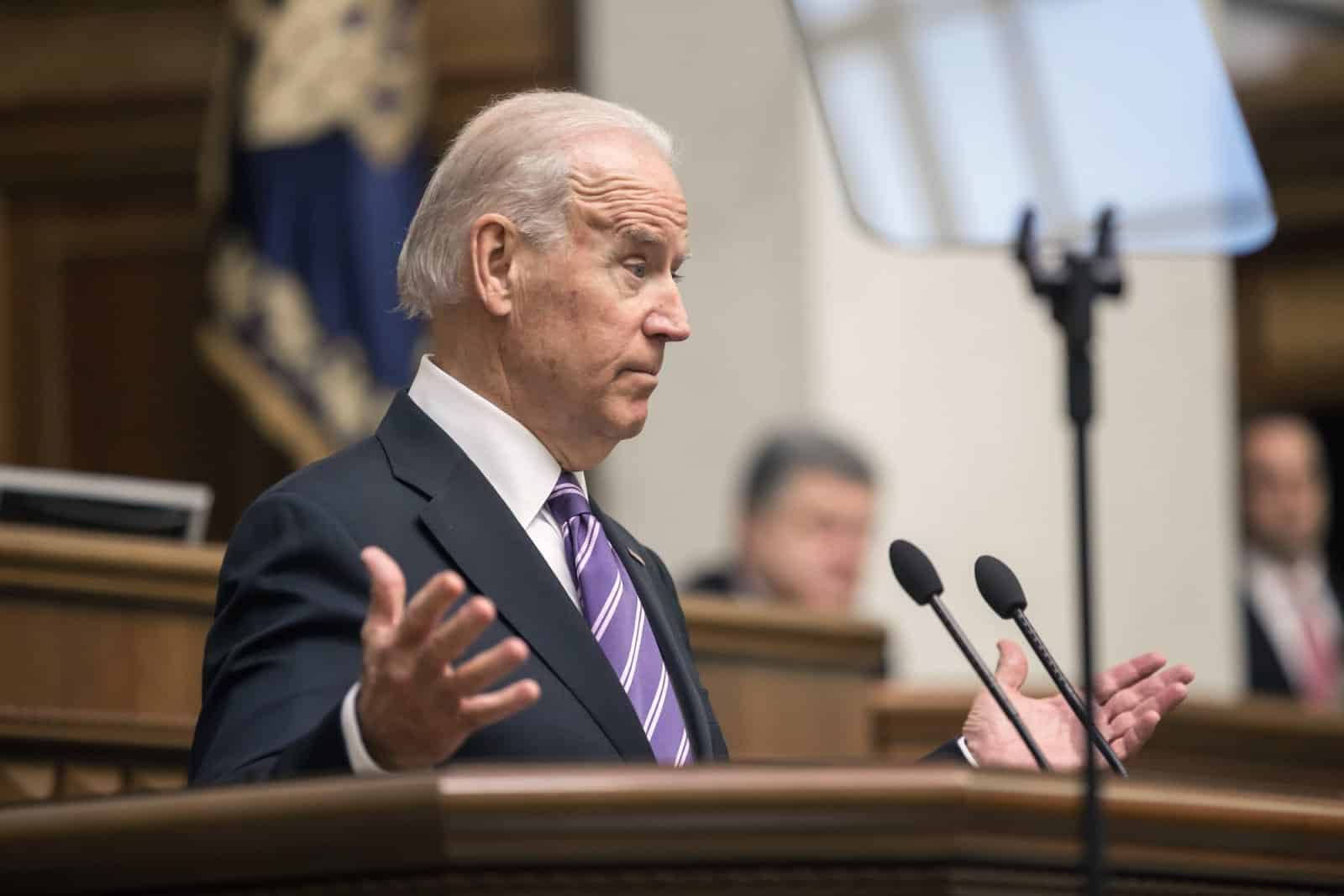

A Broader Economic Initiative

President Joe Biden highlighted this fee cap at a meeting with his competition council as part of a wider effort to lower living costs and increase economic competitiveness.

This council is tasked with making the economy more consumer-friendly by reducing unnecessary expenses in various sectors.

Targeting Unfair Pricing

To further these aims, the administration is launching a “strike force” under the guidance of the Justice Department and the Federal Trade Commission.

This group is set to tackle illegal and unethical pricing practices that affect vital areas, including healthcare and housing, ensuring fairer pricing for consumers.

Cutting Down on Junk Fees

According to the White House Council of Economic Advisers, Biden’s push against junk fees could slash about $20 billion of these charges annually.

With Americans facing up to $90 billion in such fees each year, the potential savings are significant.

Challenges in Public Perception

Despite these efforts, only 34% of U.S. adults approve of Biden’s economic leadership. This presents a considerable challenge as the administration works to prove its dedication to improving the economy.

Record High Credit Card Debt

U.S. credit card debt has soared to a record-breaking $1.05 trillion in the third quarter of 2023. The high interest rates on this debt, the highest since the 1990s, are placing a heavy financial load on consumers.

Consumer Delinquencies on the Rise

There has been an increase in credit card payment delinquencies, highlighting that many households are struggling financially. This trend is concerning, especially for those already impacted by inflation.

Major Moves in the Credit Industry

The acquisition of Discover Financial by Capital One for $35 billion reflects the strategic moves within the credit card market.

Such mergers reflect how companies are adapting to changes in consumer debt and spending habits.

Past Efforts to Regulate Credit Card Fees

Previous legislative measures, like the CARD Act of 2010, aimed to shield consumers from excessive credit card fees.

The CFPB’s current initiative to limit these fees further builds on these earlier efforts, seeking to offer even greater protection.

A Closer Look at Overdraft Fees

Mirroring its stance on late fees, the CFPB has also proposed to limit overdraft fees. This would require banks to justify any fees above a certain benchmark, aiming to keep banking costs down for consumers.

A Focus on Junk Fees with an Eye on the Election

Eliminating junk fees is a key aspect of Biden’s economic strategy as the next presidential election approaches.

This focus is part of a broader campaign to alleviate the financial pressures faced by consumers, particularly in banking.

Fairer and More Transparent

The Biden administration’s effort to cap credit card late fees at $8 is just one part of a comprehensive plan to ease the financial burdens on Americans.

By addressing issues across a variety of sectors with strict regulations, the initiative promises a fairer and more transparent financial environment for all consumers.

The post Biden Caps Credit Card Late Fees at $8, Saving Consumers Billions first appeared on Swift Feed.

Featured Image Credit: Shutterstock / Drop of Light.