It’ll come as a surprise to nobody that the UK economy has been performing rather poorly for the last few years. A series of domestic and political events have combined to ensure UK finances are in poor shape. Here’s how Labour plans to reverse this decline.

UK Economy – The Big Picture

Slow growth has been the biggest problem with the UK economy over the last decade. Although the economy has grown in 2024, it is slower than almost all other G7 economies. Here are a few of the issues.

Productivity Down

A big problem for the UK economy is low Productivity. According to the Commons Library, “Productivity across the whole UK economy decreased by 1.0% in Q4 2023 compared with the previous quarter. Compared with the previous year, it was down by 0.3%.”

Lower Business Investment

Businesses in the UK have invested significantly less in technology and infrastructure than in other countries. This figure is increasing, though. According to the Office for National Statistics data, “Annual UK GFCF (gross fixed capital formation) increased by 2.2% in 2023, revised down from a 2.9% increase in the provisional estimate.”

High National Debt

Although economists don’t worry about the national debt, it still requires money to service. That money could be spent on infrastructure, lowering tax burdens, improving public services, etc. According to government figures, at the end of March 2024, the national debt was 98.3% of GDP, compared to 95.7% a year before.

High Inflation Strangling Household Finances

The Bank of England base rate is at its highest since 2007. While many anticipate it’ll be reduced over the summer, it is still high. This has implications for the cost of borrowing and consumer confidence.

Weak Pound Causes Issues

Although the pound has been rising in value, it is still historically weak. It’s approaching the all time lows against the dollar, and hasn’t ever recovered in value against the Euro since Brexit. This makes global trade more difficult because it costs us more in real terms to import.

Where Did the Issues Stem From?

You can start with austerity. Whilst the huge government spending cuts were a short term success, cutting the budget deficit and giving voters more confidence in the Tory plan, experts argue the lack of investment cost us in the longer term.

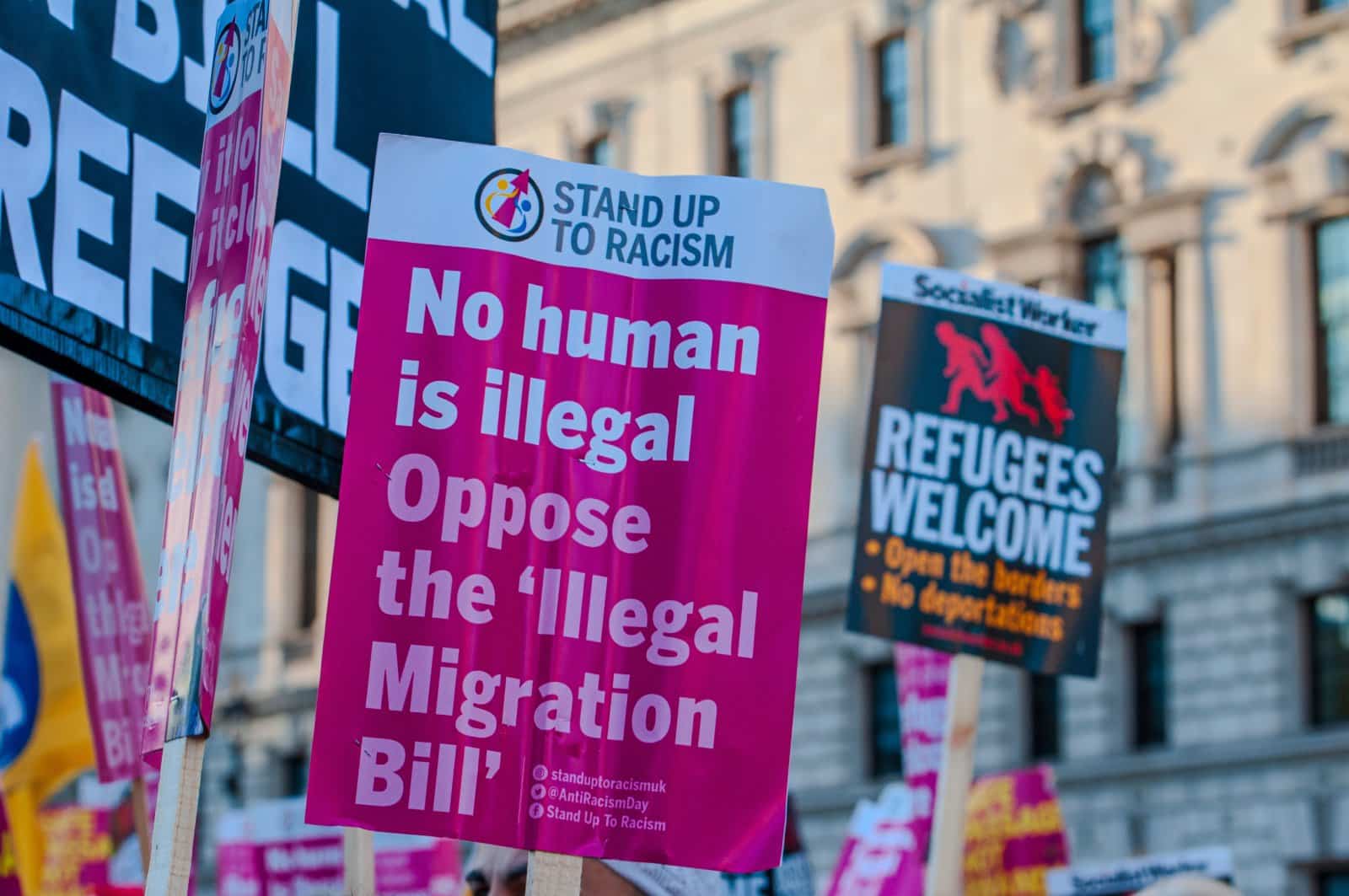

Brexit, Bloody Brexit

The major elephant in the room, though, is Brexit. There’s no denying that it crashed the pound, made trade more difficult, reduced workforce size, and soured relations with our biggest trading partner. It hasn’t delivered a fraction of the so-called benefits we were promised.

Research Says Brexit Hurting Economy

A report by the National Institute of Economic and Social Research says, “Our estimates suggest that had the post-2010 trends been sustained, real income and private consumption per capita could have been 8-9 per cent and 11-12 per cent higher than current figures, respectively.”

A Growing Body of Voices Wants to Improve Relationship With Europe

Whilst Labour has ruled out rejoining the EU, there is a discussion to be had with Europe regarding trade, immigration, and access to markets. A more open relationship with European markets will certainly help British businesses.

Labour Plan of Attack to Improve the Economy

The Labour Party claims it has five missions to grow the UK economy. They start with government spending – promising that a ‘fiscal lock’ will be implemented. This means any government spending will be accompanied by a forecast from the Office of Budget Responsibility.

Kickstart House Building

Housing in the UK is a mess. Prices are rising faster than many young and single people can keep up with. It has created a ‘generation rent’ of people who want to buy a house, but rising prices mean they can’t. Labour has promised to build 1.5 million new homes across the UK.

Building Means Jobs and Skills

As part of their plan, Labour will introduce Technical Excellence Colleges, which are designed to address the country’s skills gap. By training a new generation of tradespeople, engineers, and the like, we will have a better, more resilient workforce.

Increase Business Investment

UK business investment has lagged other countries for years, hurting our economy. Labour wants to create a National Wealth Fund designed to increase investment in British businesses.

Harnessing Green Power

Labour plans to increase the UK’s ability to generate green power using wind and solar energy. The UK is uniquely positioned to meet almost all of our power requirements using wind and solar energy, which should lower bills and reduce reliance on imported fossil fuels.

Reducing National Debt

Shadow Chancellor Rachel Reeves said Labour would look “to reduce national debt as a share of the economy.” While this does not say they’ll pay it down, it indicates they’ll be aggressive in their plans to grow the economy.

Can Labour Do It?

We have to hope so. The reality is there are problems with the UK economy, but the good news is they are very fixable. Investment in the green energy and housing sectors is a big win because it can solve a power problem and, hopefully, reduce bills.

Skills Means Better Jobs

A better workforce will improve Productivity in the economy and encourage businesses to open up here. We no longer offer enticing access to Europe, so we need to provide excellent quality work and friendly tax rates.

We Need to Repair Our Relationship With Europe

If we want a quick and reliable economic boost, we must solve our differences with Europe. Brexit has introduced tariffs and red tape, making life much more complex and competitive for European British businesses. Labour needs to fix that.

Will It Happen?

Labour is likely to be the next party in power, so we have to hope so. They’ve got a plan and a population fed up with Tory mismanagement of the economy. Let’s hope Labour gets it right.

The post Labour’s Economic Revival Plan – Can It Rescue the UK From Decline? first appeared on Swift Feed.

Featured Image Credit: Shutterstock / Rupert Rivett.