In a landmark decision, former IRS consultant Charles Littlejohn has been sentenced to five years in prison for his role in leaking confidential tax filings, including those of former President Donald Trump and numerous wealthy individuals. The sentencing, delivered by District Court Judge Ana Reyes, has sparked debates about the boundaries of transparency and national security.

Maximum Sentence Decision

Judge Reyes endorsed the Justice Department’s request for the maximum statutory sentence, characterizing Littlejohn’s actions as “an attack on our constitutional democracy” and a direct challenge to the nation’s democratic foundations.

Targeting Democracy and the Office

In a strongly worded statement, Judge Reyes emphasized the severity of targeting the President’s tax records, stating, “When you target the sitting president of the United States, you’re targeting the office, and when you’re targeting the office of the president of the United States, you’re targeting democracy — you’re targeting our constitutional system of government.”

Legal Obligations and Capitol Attacks

Reyes compared Littlejohn’s actions to the Capitol Riots, suggesting, “It cannot be open season on our elected officials — it just can’t.”

Plea for Leniency

Littlejohn’s representatives expressed remorse on his behalf and advocated for a reduced sentence of 12-18 months. However, the court decided differently, aligning with the Justice Department’s stance.

Defense’s Regretful Admission

Acting Assistant Attorney General Nicole M. Argentieri commended the judge’s ruling, stating that the five-year prison sentence sends a resounding message about the gravity of violating laws designed to safeguard sensitive tax information. Argentieri stressed the importance of upholding the integrity of tax data protection.

“A Strong Message”

“Today’s sentence sends a strong message that those who violate laws intended to protect sensitive tax information will face significant punishment,” said Argentieri.

The Times and ProPublica

The New York Times and ProPublica, the recipients of the leaked data, have raised concerns about the sentence’s severity, describing it as “harsh” and “deeply troubling.”

Spokeswoman’s Statement

They argue that the leaks played a vital role in informing the public about the financial ties and tax strategies of influential figures, shedding light on their financial activities.

The Public’s Right to Information

The debate surrounding the case highlights the complex interplay between government transparency, national security, and the public’s right to information.

Whistleblower Protection

ProPublica argued for the protection of whistleblowers, “Whistleblowers are often the lifeblood of investigative journalism,” said spokeswoman Alexis Stephens.

“Protection not Prosecution”

According to Stephens and ProPublica, whistleblowers “deserve protection not prosecution.”

Wealthy Individuals’ Tax Data

Littlejohn leaked tax strategies to ProPublica on thousands of people, including some of the world’s richest businessmen, like Elon Musk, Jeff Bezos, and George Soros.

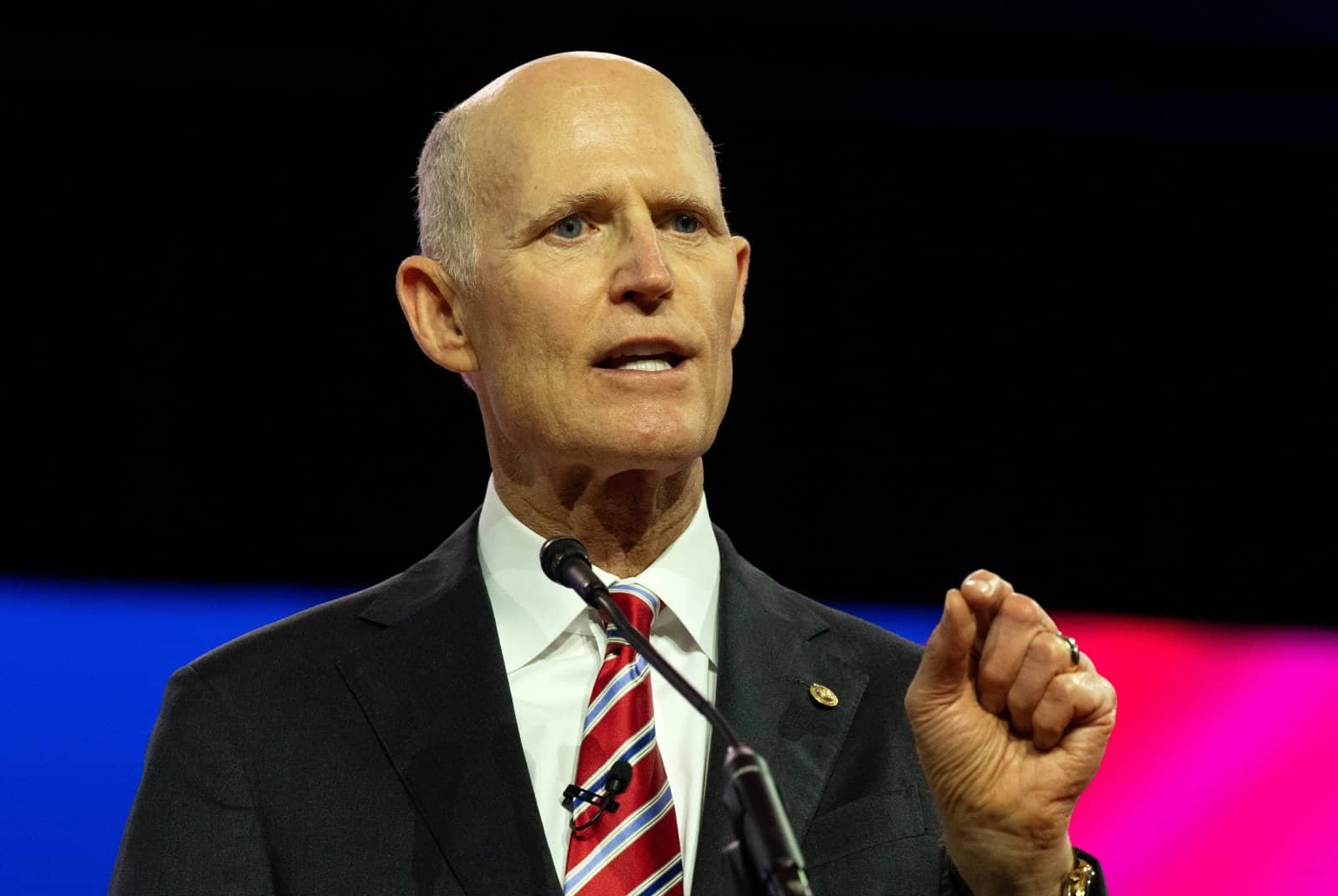

Request for Maximum Sentence

Senator Rick Scott, whose filings were leaked, attended the sentencing, advocating for the maximum sentence and expressing satisfaction with the verdict.

Judicial System’s Message

House Ways and Means Chair Jason Smith praised the judge’s sentence, claiming it sends a “strong message that the U.S. judicial system takes these crimes seriously.”

Frustration with Trump’s Refusal

Littlejohn claimed he was concerned about income inequality and the fact that Trump broke a tradition of Presidents voluntarily releasing their tax filings.

Judge’s Assertion

Judge Reyes asserted the right to privacy for Trump and others, “We’re told by the press that democracy dies in darkness — it also dies in lawlessness,” she said.

Noble Intentions?

Reyes concluded that there was nothing “noble or moral” about Littlejohn’s offense, as lawful means could have achieved any societal benefits.

The post Tax Whistleblower Receives 5-Year Term for Leak first appeared on Swift Feed.

Featured Image Credit: Shutterstock / everything possible.

The content of this article is for informational purposes only and does not constitute or replace professional financial advice.